Flexible funding built

for your golf course

Maintain cash flow. Finance new projects. All with

Lightspeed Capital, our merchant cash advance program. Email [email protected] to inquire about your eligibility.*

Welcome to a new era

of business funding.

Why choose Lightspeed Capital? We believe business owners should have better access to funding. Our process is simple: there’s no red tape or lengthy application, so you get your funds sooner.

- Enjoy funding without personal credit checks—there’s no impact on your score

- Find relief with our flat-fee structure: no fluctuating interest or hidden costs

- Invest in your business instantly when your cash advance is deposited into your bank account in as soon as two business days

- Use Lightspeed Capital for any business purpose, project or expense

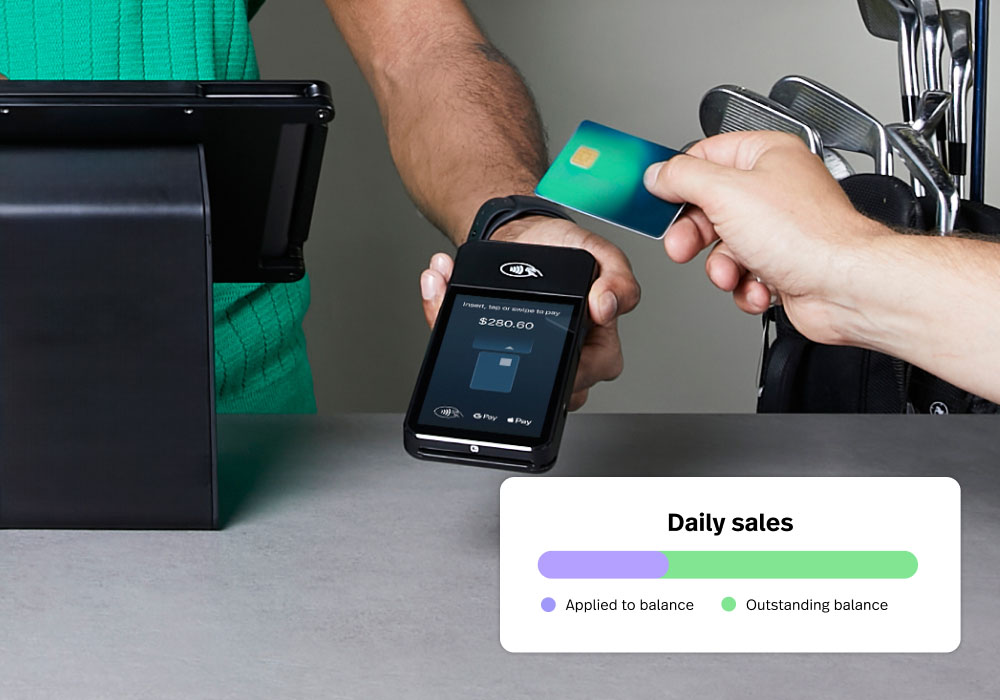

Our simple remittance process guarantees less stress.

Unlike a traditional loan, you can use your cash advance on your own schedule for any business expense. Remit it as you go,

only when you make sales.

- No collateral, credit checks or compounding interest rates

- Remit on your own time: there are no scheduled monthly payments

- The full amount, including the flat fee, is remitted through a percentage of your daily sales

- Request Capital again after your balance is remitted in full

Local businesses are the backbone of our communities, and Lightspeed’s goal is to make owning a successful independent business easier than ever. We believe real-time access to capital is one of the largest challenges facing independent merchants today. This expansion of Lightspeed Capital provides a simple, streamlined opportunity for our merchants to invest in their business. Our goal is to help turbocharge their operations ... all through a single, integrated commerce solution.

Dax Dasilva, Lightspeed CEO

Want to grow your business? We’ve got you.

Lightspeed Capital frees you from the constraints of traditional financial aid, so you can grow your business with easily accessible, renewable funding. Give your golfers a better experience when you invest in your business. With Lightspeed Capital, you can:

- Purchase extra pro shop inventory to meet sales demand

- Buy new equipment to optimize your course

- Invest in staffing as your club grows

- Prepare for peak golfing seasons

Looking for business stability? Let us help.

In times of economic uncertainty or in the off season, you can rely on Lightspeed Capital to support your business. Take advantage of a cash advance to stabilize your cash flow and keep your course running smoothly. With Lightspeed Capital, you can:

- Bulk up your cash flow to prepare for low seasons

- Pay unexpected business bills and expenses

- Get business financing without the stress of credit checks

- Remit the cash advance only when you make sales

Learn more about

your eligibility.

If you’re already a Lightspeed customer, here are the eligibility requirements you need to know about:

- Eligibility is determined by factors related to business performance, including sales history and tenure with Lightspeed

- Lightspeed Payments’ subscribers are automatically reviewed for eligibility on a monthly basis

- Offers will remain available for up to 30 days, after which the offer will expire and you will be reevaluated for eligibility

- Email [email protected] to inquire about your eligibility